Blockchain and Insurance: How Decentralization is Transforming the Industry

Key takeaways

Blockchain has the potential to transform the insurance industry in profound ways. From improving transparency to reducing costs, the benefits are clear. As more companies begin to adopt this technology, we can expect to see even more exciting innovations in the years to come.

- Blockchain can improve efficiency and reduce costs for insurance companies.

- The use of smart contracts and distributed ledger technology can streamline processes such as underwriting and claims processing.

- Blockchain can enhance security by providing a secure and transparent platform for storing and sharing data.

- Customers can benefit from faster claims processing, transparent policies, and lower premiums, which can improve customer satisfaction and retention.

- The future of blockchain and insurance is exciting, with trends such as increased adoption, interoperability, integration with other technologies, regulatory changes, and new business models.

Introduction

Although the insurance industry has been around for centuries, it's no secret that it's been slow to adopt new technologies. However, the emergence of blockchain has started to change that. In this e-book, we'll explore the ways that blockchain is transforming the insurance industry, and how it's being used to create more transparent, efficient, and secure insurance policies.

Before we dive into blockchain and insurance, let us take a moment to explore the history of insurance, how insurance exchanges are conducted currently pre-blockchain and Web 3.0, and where exactly blockchain originated.

The History of Insurance

Insurance as a concept has been around for centuries, long before the advent of modern technology. In fact, the earliest forms of insurance can be traced back to ancient times, to as early as the 18th century with King Hammurabi’s Code. The king’s code is considered to be the first written account of insurance in human history. The code listed ‘laws’ of sorts which included one stating that someone in debt would not have to pay back a loan if some unforeseen calamities were to take place and make them unable to do so (Beattie 2022). In addition, merchants and traders would take out loans to finance their expeditions and would pay a fee to insure their ships and cargo against loss or damage.

In the medieval era, the concept of insurance evolved further with the rise of guilds and trade associations. These organizations would pool resources to provide members with financial protection against risks such as fire, theft, and liability. Members of these associations would contribute regular fees to a common fund, and in the event of a loss, the fund would be used to compensate the affected member.

Merchants and traders faced a range of risks while conducting business, including the risks of theft, damage to goods during transport, and the risks of natural disasters such as fires and floods. To protect themselves against these risks, merchants would often enter into informal agreements with each other, agreeing to share the risks and losses associated with their trade. One common arrangement was the "bottomry" contract, which was a type of loan that was secured by the cargo on a ship. If the ship sank or the cargo was lost during the voyage, the lender would lose their investment. However, if the ship arrived safely and the cargo was sold, the lender would receive their investment back plus interest.

Another common arrangement was the "tontine", which was a type of investment scheme where individuals would pool their money together and agree to pay each other a regular income. When a member of the tontine died, their share of the pool would be divided among the surviving members, with the last surviving member receiving the entire pool. These early forms of risk-sharing and pooling can be seen as early precursors to modern insurance. However, it wasn't until the 17th century that formalized insurance contracts began to emerge, with the establishment of Lloyd's of London and the first marine insurance policies.

Lloyd’s of London, a coffeehouse owned by Edward Lloyd, acted as a primary meeting place for ship owners and merchants seeking to insure their properties (Beattie 2022). Being a coffeehouse, Lloyd's was not an insurance company in the traditional sense, but rather a marketplace where brokers could connect with underwriters and offer insurance policies to customers. The use of actuarial tables to calculate risks and premiums also began to emerge during this time.

The 18th and 19th centuries saw the development of life insurance and other forms of non-marine insurance. In the late 18th century, a few specialized life insurance companies began to emerge, such as the Equitable Life Assurance Society, which was founded in London in 1762. These companies offered life insurance policies to individuals, but their products were primarily geared towards the wealthy, and the premiums were often prohibitively expensive for the average person. The 19th century was a period of significant growth and innovation for the insurance industry. With the rise of industrialization and global trade, new types of risks emerged, and insurance companies began to develop new products to meet the changing needs of businesses and individuals.

One of the most significant developments during this period was the growth of life insurance. As people began to live longer and medical knowledge improved, life insurance became a more viable and attractive product. Life insurance companies began to use actuarial science to calculate risks and premiums, and policies became more affordable and accessible to the public.

Another important development was the expansion of fire insurance. With the growth of cities and the increasing use of industrial machinery, the risks of fire damage increased dramatically. To address this, insurance companies began to develop new fire insurance products that provided more comprehensive coverage for businesses and homeowners.

In addition to life and fire insurance, new types of insurance products emerged during the 19th century, including accident insurance, marine insurance, and liability insurance. These products provided coverage for a wide range of risks, from injuries and illnesses to property damage and legal liabilities.

A key trend in the insurance industry during the 19th century was the development of specialized insurance companies. These companies focused on specific types of risks, such as fire or life insurance, and used specialized knowledge and expertise to assess and manage these risks. This specialization allowed insurance companies to provide more targeted and effective coverage, which in turn helped to expand the overall market for insurance products.

The 20th century saw the emergence of new forms of insurance, such as health insurance and automobile insurance. These new forms of insurance were made possible by advances in medical science and the mass production of automobiles. The 20th century was a time of significant expansion and evolution for the insurance industry. The industry continued to develop new products and services to meet the changing needs of businesses and individuals, and it played an increasingly important role in the global economy.

A notable advancement during the 20th century was the growth of health insurance. As medical understanding and technology continued to advance, the cost of healthcare increased, and individuals and businesses began to seek out ways to manage these costs. Health insurance emerged to help cover the expenses of medical care, and it became an increasingly important product throughout the century.

Another key trend in the insurance industry during the 20th century was the growth of international insurance. As businesses and individuals became more connected across borders, the risks they faced also became more complex and global in nature. Insurance companies responded by developing new products and services that could help manage these risks on an international scale, including global property and casualty insurance, international health insurance, and political risk insurance.

The 20th century also saw significant advancements in technology that impacted the insurance industry. The introduction of computers and data processing systems made it possible for insurance companies to better manage and analyze large amounts of data, which in turn helped them to make more informed underwriting and pricing decisions. In addition, the growth of the internet and digital technologies in the late 20th century paved the way for the development of new types of insurance products and distribution channels, including online insurance marketplaces and digital insurance policies.

Another important development during the 20th century was the increased regulation of the insurance industry. Governments around the world began to implement new laws and regulations aimed at protecting consumers and ensuring the financial stability of insurance companies. These regulations set standards for the solvency and financial reporting of insurance companies, and they also established consumer protections and standards for the marketing and sale of insurance products.

Insurance today

Today, insurance is handled through a complex network of intermediaries, insurers, and reinsurers. The process typically begins with a potential policyholder seeking insurance coverage for a particular risk, such as property damage, liability, or health care costs.

The potential policyholder contacts an insurance broker or agent, who will help assess the risk and find an appropriate insurance policy from a range of insurers. The broker or agent acts as an intermediary between the policyholder and the insurer and may also provide advice on risk management and loss prevention.

Once the policyholder and insurer have agreed on the terms of the policy, the policy is issued, and premiums are paid on a regular basis to maintain coverage. If a loss occurs, the policyholder will file a claim with the insurer, who will then assess the claim and determine whether it is covered by the policy.

If the claim is covered, the insurer will pay out the claim amount to the policyholder, minus any deductibles or other expenses. If the claim is not covered, the policyholder may appeal the decision or seek legal recourse.

Insurers themselves also rely on a network of reinsurers to spread the risk of losses across a wider pool of insurers. Reinsurers provide insurance to insurers, allowing them to cover losses beyond their capacity to pay. This helps ensure that insurers can continue to provide coverage to policyholders even in the event of large or catastrophic losses.

Insurance companies also rely on advanced data analysis and actuarial techniques to price policies accurately and manage risk. This involves collecting and analyzing data on a wide range of factors, such as age, gender, health status, and driving habits, to calculate the probability of loss and set premiums accordingly.

Insurance has come a long way over the centuries, but there is still ample room for improvement. Being as insurance companies today rely heavily on a complex network of intermediaries, the costs and opportunities for error throughout the process are plentiful. This where the need for a new way of doing insurance comes in. Web 3.0 and blockchain offer many solutions to the issues created through today’s insurance processes with its decentralization of the internet, which we’ll get into later. But where exactly did these revolutionary technological advances originate?

Web 3.0 and Blockchain: where did they come from?

At its core, Web 3.0 is a concept for a new stage of the World Wide Web that is decentralized, intelligent, and interoperable, using technologies such as blockchain, artificial intelligence, and the Internet of Things (IoT) to create a more seamless and personalized online experience.

To better understand Web 3.0, let’s take a quick look at its precursors, Web 1.0, and Web 2.0:

Web 1.0, also known as the "static web," refers to the early days of the World Wide Web when websites were primarily static, one-way information sources. The history of Web 1.0 can be traced back to the early 1990s, when the first web browsers and web servers were developed.

In the early days of the Web, websites were primarily text-based and often lacked images, videos, or other multimedia content. Web pages were designed using HTML, a markup language that allowed web developers to create basic pages with headings, paragraphs, and hyperlinks.

During this time, there were only a limited number of websites available, and most of them were owned and managed by academic or research institutions. Some of the earliest websites included CERN's website, which was the birthplace of the World Wide Web, and the first commercial website, which was launched by Pizza Hut in 1994 (Hoffmann 2020).

As the Web grew in popularity, more companies and individuals began creating their own websites, and new technologies were developed to make websites more interactive and engaging. One of the earliest examples of a more interactive website was the online bookstore Amazon, which was launched in 1995 and allowed customers to purchase books online.

However, the early Web was still limited in terms of functionality, and most websites were still primarily static, with little user interactivity or dynamic content. This began to change in the late 1990s with the emergence of Web 2.0 technologies.

Web 2.0 is a term that was coined in the early 2000s to describe a new stage of the World Wide Web that was characterized by user-generated content, social networking, and interactive applications. The emergence of Web 2.0 was driven by a range of technological innovations and changes in user behavior and expectations.

One of the key technological innovations that enabled Web 2.0 was the development of new programming languages and tools that allowed developers to create more interactive and dynamic websites. Technologies such as AJAX (Asynchronous JavaScript and XML) made it possible to create web applications that could update content dynamically without requiring a page refresh, creating a more seamless and responsive user experience.

Another key driver of Web 2.0 was the rise of social media and user-generated content. Platforms such as MySpace, Facebook, and Twitter enabled users to create and share content with their friends and followers, leading to a new era of online collaboration and social interaction.

Blogging and other forms of online publishing also became increasingly popular during this time, allowing individuals to share their thoughts and ideas with a global audience. The emergence of platforms such as WordPress and Blogger made it easy for anyone to create a blog, leading to a proliferation of online content and the democratization of publishing.

The rise of cloud computing and software-as-a-service (SaaS) also played a role in the development of Web 2.0. Cloud-based platforms such as Google Docs and Dropbox made it possible for users to collaborate on documents and share files more easily than ever before, while SaaS applications such as Salesforce and HubSpot provided businesses with new tools for managing customer relationships and marketing campaigns.

Today, we’re witnessing the next big paradigm shift in the internet world: Web 3.0. Its characterized by “decentralization, openness, and greater user utility” (James 2022).

The origins of Web 3.0 and blockchain can be traced back to the early days of the internet and cryptography.

The concept of a decentralized web was first proposed by Tim Berners-Lee, the inventor of the World Wide Web, in the late 1990s. Berners-Lee envisioned a web where information could be shared and accessed securely and transparently, without the need for intermediaries or centralized control.

Around the same time, the foundations of blockchain technology were being laid by researchers and cryptographers such as Stuart Haber and W. Scott Stornetta. In 1991, they proposed a cryptographically secure chain of blocks that could be used to timestamp digital documents and prevent tampering.

The breakthrough that brought together the decentralized web and blockchain technology was the invention of Bitcoin, the first decentralized cryptocurrency, in 2008. Bitcoin was based on a decentralized ledger called the blockchain, which enabled secure and transparent peer-to-peer transactions without the need for intermediaries such as banks or payment processors.

Over the years, the potential of blockchain technology has expanded beyond cryptocurrencies, with the development of smart contracts and decentralized applications (dapps) that can run on blockchain networks. This has enabled the creation of decentralized platforms for a wide range of use cases, from supply chain management and digital identity to social media and gaming.

Today, Web 3.0 is a rapidly evolving ecosystem of decentralized technologies, with blockchain at its core. While the full potential of Web 3.0 is still unfolding, decentralized technologies such as blockchain will play a key role in shaping the future of the internet and many industries, including finance, healthcare, and insurance.

Chapter 1: the basics of blockchain

Now, before we dive into how blockchain is being used in the insurance industry, let's start with the basics. We'll explore what blockchain is, how it works, and why it's such a revolutionary technology.

A Brief history of blockchain

The concept of a digital ledger that records transactions in a secure and decentralized manner dates back to the 1990s. However, it was not until the release of Bitcoin in 2009 that the term "blockchain" became widely known. Bitcoin's creator, who is known by the pseudonym Satoshi Nakamoto, designed blockchain as a way to solve the problem of double spending in digital currencies.

Blockchain's technical aspects

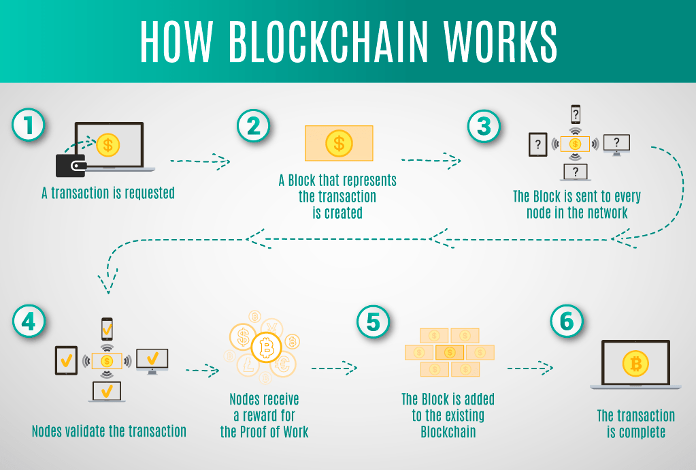

At its core, blockchain is a decentralized database that maintains a continuously growing list of records, called blocks, which are linked and secured using cryptography. Each block contains a hash, which is a unique identifier of the block, and a timestamp that indicates when the block was created. The hash of each block also includes the hash of the previous block in the chain, forming a sequence of blocks that cannot be altered without invalidating the entire chain.

The blocks are verified and validated by a network of users, called nodes, using consensus algorithms. There are several consensus algorithms used in blockchain, such as proof-of-work (PoW), proof-of-stake (PoS), and delegated proof-of-stake (DPoS). PoW is the algorithm used in Bitcoin, where nodes compete to solve complex mathematical problems to validate transactions and add new blocks to the chain. PoS and DPoS are more energy-efficient algorithms that rely on nodes staking their cryptocurrencies to validate transactions and create new blocks.

(Lastovetska 2021)

Blockchain's technical aspects

One of the main benefits of blockchain is its decentralized nature, which eliminates the need for a central authority to oversee transactions. This makes blockchain more secure and less vulnerable to fraud and hacking. Additionally, blockchain's transparency allows all participants to view and verify transactions, increasing trust and accountability.

Applications of blockchain

Blockchain's potential applications are vast and varied. One of its most well-known applications is in cryptocurrencies, such as Bitcoin and Ether. However, blockchain is also being used in industries such as supply chain management, voting systems, digital identity verification, and most importantly for us, insurance.

In supply chain management, blockchain can be used to track products from their origin to their final destination, providing greater transparency and accountability. In voting systems, blockchain can enable secure and transparent voting that is resistant to fraud and hacking. In digital identity verification, blockchain can provide a decentralized and secure way to verify identities, eliminating the need for centralized databases that are vulnerable to hacking.

Blockchain is a revolutionary technology that has the potential to transform industries in countless ways, including the insurance industry. Its decentralized nature and transparency offer greater security and accountability, while its potential applications are vast and varied. As we move forward in exploring how blockchain can be used in insurance, it's important to keep in mind the benefits and limitations of the technology and how it can best be leveraged to improve processes, increase efficiency, and provide better value for customers.

Chapter 2: how blockchain is transforming insurance

Blockchain technology has the potential to disrupt many industries, and insurance is no exception. The decentralized and secure nature of blockchain can transform the insurance industry by providing more transparency, efficiency, and security. In this chapter, we will explore the applications of blockchain in the insurance industry as well as the benefits and challenges associated with its implementation. First, let’s dive into how blockchain utilizes smart contracts, fraud prevention, data management, and peer-to-peer insurance to create a more streamlined insurance experience.

Smart contracts

One of the most promising use cases for blockchain in insurance is the use of smart contracts. Smart contracts are digital programs that run on blockchain technology and automatically enforce the terms of an agreement between parties, improving transparency and efficiency. In the insurance industry, smart contracts can be used to streamline claims processing and reduce the time and cost associated with traditional insurance processes.

One of the many ways to use smart contracts in insurance is in the creation of parametric insurance policies. Parametric insurance policies are designed to automatically pay out when certain predefined events occur. For example, a policy might be created that pays out if a certain weather condition is met, such as a hurricane or earthquake. With smart contracts, the policy terms can be encoded into the blockchain, and the contract can be programmed to automatically execute when the predefined conditions are met. This can greatly reduce the time and cost associated with claims processing, as there is no need for manual verification or negotiation.

(Szakiel 2022)

Another use case for smart contracts in insurance is in automating the claims process. Smart contracts can be programmed to automatically verify claims and pay out benefits, reducing the need for human intervention. For example, if a policyholder files a claim for a car accident, the smart contract could automatically verify the details of the accident and payout the appropriate amount to the policyholder. The automation of the claims payment processes with smart contracts means policyholders will get paid faster than with the manual processes of today (Berry 2016).

Fraud prevention

Today, approximately 5 to 10 percent of all claims are fraudulent, which costs U.S. insurers an upwards of $40 billion per year (Lorenz, et al. 2016). Fraud prevention is an increasingly important issue in the insurance industry, as it not only affects the financial stability of insurance companies but also has a significant impact on policyholders. Insurance fraud can result in higher premiums, reduced coverage, and even the denial of claims. In this context, blockchain technology has emerged as a potential solution for preventing and detecting fraud in the insurance sector.

One of the key advantages of blockchain is its ability to create a transparent and immutable record of all transactions. By using blockchain to store insurance transactions, insurance companies can create a tamper-proof ledger that can be used to verify the authenticity of claims and prevent fraudulent activity. This technology can also be used to create a secure and transparent record of policyholder information, ensuring that data is accurate and up to date.

In addition to its ability to create a transparent and secure record of insurance transactions, blockchain can also be used to create a decentralized network of trusted parties. By using blockchain to establish such a network, insurance companies can ensure that claims are verified by multiple parties, reducing the risk of fraud. For instance, if a policyholder files a claim for a car accident, the claim can be verified by the parties on the blockchain, such as the insurance company, the police department, and the repair shop.

Improved data management

Improved data management is a crucial component for the success of any business in the digital age. For the insurance industry, it is particularly essential as it deals with large amounts of sensitive data related to policyholders. Blockchain technology can play a significant role in improving data management in the insurance industry.

As mentioned previously, one of the most significant advantages of blockchain is its decentralized nature. By using blockchain, insurers can store and share customer data in a decentralized manner, ensuring that the data is not controlled by any single entity. This helps to improve data privacy and security, as well as reduce the risk of data breaches. The blockchain technology uses advanced cryptography to secure the data, making it virtually impossible to hack or manipulate.

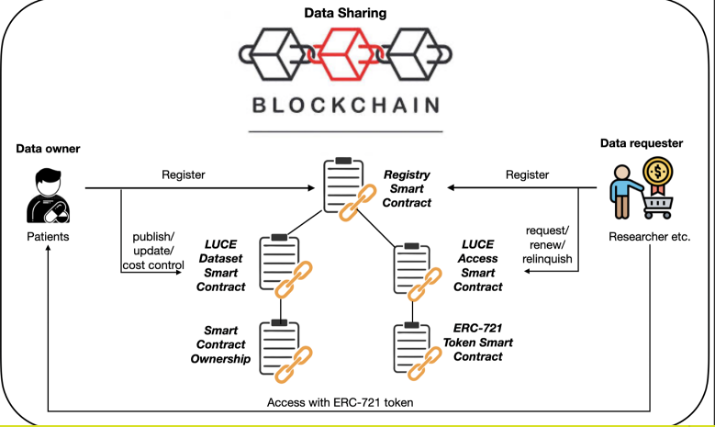

(Jaiman, Pernice and Urovi 2022)

Moreover, blockchain technology also facilitates transparency and trust among different entities. It creates an immutable and transparent record of all transactions, allowing all parties to verify the accuracy and authenticity of the data. This helps to reduce the risk of fraud and errors, making data management more efficient and reliable.

Another significant advantage of blockchain technology in data management is that it enables insurers to share data more easily and securely. By using a blockchain-based system, insurers can share customer data with other parties, such as reinsurers, brokers, and regulators, without compromising data privacy or security. This helps to streamline the insurance process and reduce administrative costs.

Peer-to-peer Insurance

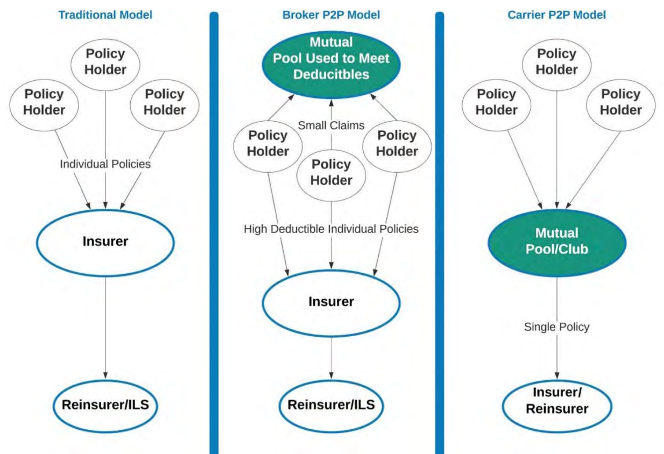

The traditional insurance industry is often criticized for being opaque, complex, and costly. While it serves a crucial role in managing risk, the traditional model can often lead to high premiums and limited access to coverage. Peer-to-peer insurance, on the other hand, is a new business model enabled by blockchain technology that seeks to address these issues.

Peer-to-peer insurance is a model where individuals can form communities to collectively insure themselves against certain risks. By pooling their resources, members of a peer-to-peer insurance community can share the risk and reduce the cost of insurance. This model is particularly attractive to those who may not be able to access traditional insurance products due to high premiums or limited coverage options.

(Esther Boyle, et al. 2021)

Blockchain technology can enable peer-to-peer insurance by providing a decentralized platform for community members to interact and share information. By using smart contracts, the platform can automate the underwriting and claims process, reducing the need for intermediaries and lowering administrative costs.

Moreover, peer-to-peer insurance offers greater transparency and control over insurance policies. Members of a peer-to-peer insurance community can participate in the decision-making process, such as setting premiums, defining coverage limits, and assessing claims. This can provide a more democratic and participatory model for insurance, enabling greater trust and accountability between members.

Peer-to-peer insurance can also enable more personalized insurance products. By leveraging blockchain technology, insurers can collect more detailed and accurate data on customer behavior and risk profiles, allowing for more customized policies. For instance, an insurer could use data from wearable devices to offer health insurance products tailored to individuals' lifestyles and health needs.

Applications of blockchain in insurance

As is known, blockchain technology has the potential to revolutionize the insurance industry by providing greater efficiency, transparency, and security in various aspects of the industry. One such area is claims management, where blockchain can help insurers automate claims processing, streamline documentation, and leverage data analytics and artificial intelligence for improved decision-making. Additionally, underwriting is an area where blockchain can bring significant benefits, including faster and more efficient processing, improved risk assessment and customization, and the creation of new business models that better meet customer needs. Let us explore the various applications of blockchain in insurance, starting with claims management and underwriting.

Claims management

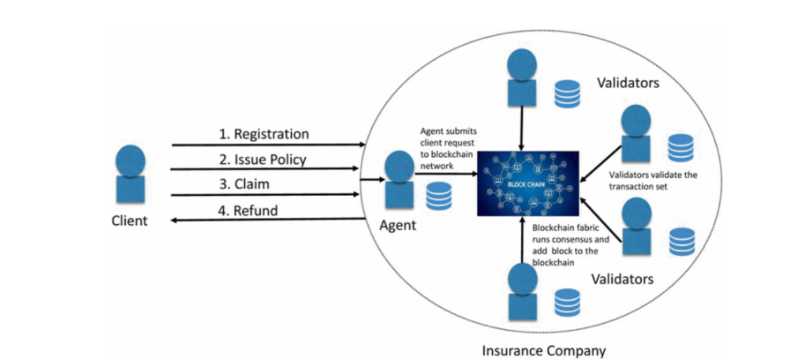

In addition to automating claims processing, blockchain can also enhance the overall claims management process by providing greater transparency and accountability. By supplying a tamper-proof record of all claims-related data, insurers can increase the accuracy and reliability of the claims process, reducing disputes and improving customer satisfaction.

(Ensuring Better Insurance with a Blockchain Framework 2018)

Moreover, blockchain can facilitate more efficient and collaborative communication between different parties involved in the claims process, such as insurers, policyholders, and third-party service providers. By using a decentralized platform, all parties can access the same information in real-time, reducing the need for manual coordination and improving the speed and accuracy of claims processing.

Another advantage of blockchain-based claims management is the ability to streamline the documentation process. Instead of relying on paper-based documentation, which can be prone to errors and delays, blockchain can provide a secure and efficient platform for storing and sharing claims-related documents. This can reduce the administrative burden of claims management, freeing up resources for more critical tasks such as risk assessment and customer service.

Additionally, blockchain can facilitate the use of data analytics and artificial intelligence (AI) to improve claims management. By using blockchain to collect and analyze data on claims patterns and customer behavior, insurers can identify trends and opportunities for improvement, allowing them to tailor their claims management processes to better meet customer needs.

As blockchain technology continues to evolve, it is likely that it will play an increasingly critical role in the claims management process in the insurance industry.

Underwriting

Underwriting is another area in which blockchain can bring significant benefits to the insurance industry. By automating certain tasks using smart contracts, insurers can reduce manual processes and improve the speed of policy issuance.

Furthermore, blockchain can provide a secure and transparent platform for tracking and managing policyholder data throughout the underwriting process. This can help insurers to identify potential areas of risk and make more informed decisions when setting premiums and coverage limits.

In addition, blockchain can enable insurers to manage their reinsurance activities more effectively. By creating a shared database of reinsurance transactions, insurers can more easily manage their risk exposure and ensure that they are adequately covered in the event of a large-scale loss event.

Another advantage of using blockchain for underwriting is the ability to create new business models that better meet the needs of customers. For example, blockchain can enable the creation of microinsurance policies that provide coverage for specific risks or events, such as travel insurance or rental insurance. This can provide a more affordable and accessible alternative to traditional insurance policies, particularly for underserved populations.

The use of blockchain technology in underwriting offers significant advantages over traditional underwriting methods, including faster and more efficient processing, improved risk assessment and customization, and the ability to create new business models that better meet customer needs. As such, it is likely that blockchain will continue to play an increasingly important role in the underwriting process in the insurance industry.

Chapter 3: the benefits of blockchain for insurance companies

The use of blockchain technology in the insurance industry has the potential to revolutionize the way insurers conduct business. As blockchain technology continues to evolve, insurance companies are starting to realize the potential benefits it can offer. In this chapter, we will explore in detail the various benefits of blockchain technology for insurance companies.

Reduced Costs

One of the most significant benefits of blockchain technology for insurance companies is the potential to reduce costs. Blockchain technology can help insurers eliminate intermediaries and automate processes, leading to significant cost savings. By using smart contracts and distributed ledger technology, insurers can reduce paperwork and eliminate the need for manual processes, which can result in reduced administrative costs. For example, allowing reinsurers to access claims and histories that have been cataloged on the blockchain improves transparency for said reinsurer in a way that it auditable and automated (Lorenz, et al. 2016). Additionally, blockchain technology can help insurers reduce the risk of fraud and errors, which can also lead to cost savings.

Improved efficiency

Another key benefit of blockchain technology for insurance companies is improved efficiency. Blockchain technology can help insurers streamline processes such as underwriting, claims processing, and customer onboarding. By automating these processes using smart contracts and distributed ledger technology, insurers can reduce paperwork, reduce processing times, and improve customer experience. For example, by automating the underwriting process using blockchain, insurers can quickly and accurately assess risks and make informed decisions about policy issuance.

Enhanced Security

Blockchain technology can also enhance security for insurance companies by providing a secure and transparent platform for storing and sharing data. With blockchain technology, insurers can ensure that customer data is secure and protected from cyber-attacks. Additionally, customers can have greater control over their data, which can help build trust and improve customer experience.

Better customer experience

By improving efficiency and reducing costs, blockchain technology can help insurance companies provide a better customer experience. Customers can benefit from faster claims processing, transparent policies, and lower premiums, which can improve customer satisfaction and retention. For example, by using blockchain technology to automate claims processing, insurers can significantly reduce the time it takes to settle claims, which can lead to improved customer satisfaction.

New business models

Finally, blockchain technology can enable new business models for insurance companies. For example, insurers can use blockchain technology to offer peer-to-peer insurance, where customers can form communities to collectively insure themselves against certain risks. This can provide a more affordable and transparent alternative to traditional insurance models. Additionally, insurers can use blockchain technology to offer microinsurance policies, which provide coverage for specific risks or events, such as travel insurance or rental insurance. This can provide a more affordable and accessible alternative to traditional insurance policies, particularly for underserved populations.

Chapter 4: the future of Blockchain and insurance

The use of blockchain in the insurance industry is still in its early stages, but the potential for growth is enormous. In this chapter, we'll look at some of the trends and predictions for the future of blockchain and insurance.

The insurance industry is known for its slow adoption of new technologies. However, the potential benefits of blockchain technology in the insurance industry are too significant to ignore. By providing a secure, transparent, and decentralized platform for recording and sharing data, blockchain can streamline insurance processes and reduce fraud, ultimately leading to more efficient and cost-effective insurance services.

Increased adoption

Increased adoption of blockchain technology in the insurance industry is expected as more companies recognize the potential benefits. Blockchain can provide a competitive advantage by allowing insurers to offer new and innovative products and services based on blockchain technology. For example, as mentioned previously, blockchain can facilitate the development of peer-to-peer insurance models, where customers pool their resources to insure each other, thereby reducing overhead costs and increasing transparency.

Interoperability

Interoperability is a potential challenge that blockchain faces in the insurance industry. Interoperability in terms of blockchain and insurance refers to the ability of different blockchain networks or systems to communicate and exchange information with one another seamlessly.

In the insurance industry, interoperability is essential because multiple parties, such as insurers, policyholders, and regulators, need to access and share data securely and efficiently. With interoperable blockchain systems, parties can exchange information and execute transactions across different networks, which can help to streamline processes, reduce costs, and improve transparency.

For example, interoperability can enable insurers to share data related to policy issuance, claims, and payments across different blockchain networks, reducing redundancies and errors. It can also facilitate the creation of new insurance products and services that leverage data from multiple sources, such as weather data or IoT sensors, to create personalized policies based on the needs and behaviors of individual customers.

Different blockchain networks must be able to communicate with each other to enable seamless integration of blockchain technology into the insurance industry. Standardization of blockchain interoperability is expected to happen in the future, allowing insurers to use blockchain technology more effectively.

Integration with other technologies

Blockchain technology is not the only emerging technology transforming the insurance industry. Artificial intelligence, machine learning, and the Internet of Things (IoT) are also transforming the industry. Integrating blockchain technology with these other technologies can lead to more personalized insurance products and services based on real-time data. For example, blockchain can be used to manage IoT devices that collect data on customers' driving habits, allowing insurers to offer usage-based insurance products.

Regulatory changes

As the use of blockchain technology in the insurance industry grows, regulations and policies are expected to change to accommodate the technology. Governments and regulatory bodies will need to create new regulatory frameworks to ensure that blockchain-based insurance products and services are secure, transparent, and in compliance with existing regulations.

Conclusion: What are the next steps for insurance companies?

Blockchain technology has the potential to revolutionize the insurance industry by enabling more efficient, secure, and transparent processes. Now that we’ve explored the basics, where blockchain and insurance came from, and where we are heading, let us examine where the next steps in the process will take insurance companies in the future regarding blockchain.

Adoption of Blockchain

Insurance companies have already started to experiment with blockchain technology to streamline various processes, such as claims processing, underwriting, and fraud detection. However, to fully realize the benefits of blockchain, insurers need to adopt it on a wider scale.

Integration with legacy systems

Many insurance companies still rely on legacy systems that are not compatible with blockchain technology. Legacy systems in the insurance industry refer to older, often outdated computer systems, software, or technologies that are still being used to manage critical business operations. These legacy systems are typically built on older programming languages, hardware, and infrastructure, making them more challenging and costly to maintain and update. To overcome this challenge, insurers need to invest in updating their existing systems or developing new systems that can integrate with blockchain.

collaboration with technology partners

Insurance companies need to collaborate with technology partners, such as blockchain startups and technology providers, to develop innovative solutions that can address the specific needs of the insurance industry. This can help insurers to overcome the challenges of integrating blockchain with legacy systems and to develop more robust and scalable blockchain solutions.

Standardization

Standardization is essential for the widespread adoption of blockchain in the insurance industry. The lack of standardized protocols and data formats can create interoperability issues, making it difficult for different blockchain solutions to communicate and exchange data seamlessly.

Certainly, standardization can help to overcome these challenges by ensuring that blockchain protocols and data formats are consistent across different solutions. This can help to reduce complexity, increase efficiency, and lower costs by enabling insurers to share data more easily and securely.

In addition, standardization can provide greater clarity and transparency, which can help to build trust among different parties involved in the insurance ecosystem, including insurers, policyholders, and regulators. For example, standardized smart contract templates can help to reduce errors and disputes in the claims process, while standardized data formats can enable insurers to analyze data more effectively and make better-informed decisions.

Regulatory compliance

Blockchain solutions need to comply with regulatory requirements, such as data privacy and security regulations, anti-money laundering laws, and know-your-customer (KYC) regulations. Insurance companies need to ensure that their blockchain solutions are compliant with these regulations to avoid legal and reputational risks.

Education and training

Insurance companies need to invest in educating their employees and stakeholders about the potential benefits and risks of blockchain technology. This can help to build trust in the technology and encourage adoption among employees and customers.

To conclude, blockchain technology presents a significant opportunity for insurance companies to improve efficiency, reduce costs, and enhance customer experience. However, to fully realize the potential of blockchain, insurers need to adopt it on a wider scale, integrate it with legacy systems, collaborate with technology partners, standardize protocols and data formats, comply with regulatory requirements, and invest in education and training. By taking these next steps, insurance companies can position themselves at the forefront of the digital transformation of the insurance industry.

By harnessing the power of blockchain, the insurance industry is poised to enter a new era of trust, transparency, and efficiency. So, if you're an insurer, it's time to stop swimming against the blockchain current and start riding the wave of innovation!

Works cited

Beattie, Andrew. 2022. Investopedia. July 13.

https://www.investopedia.com/articles/08/history-of-insurance.asp.

Berry, Nicholas. 2016. Norton Rose Fulbright: The future of smart contracts in insurance. September. Accessed April 17, 2023.

https://www.nortonrosefulbright.com/en/knowledge/publications/88244592/the-future-of-smart-contracts-in-insurance.

2018. "Ensuring Better Insurance with a Blockchain Framework." IEEE Xplore.

Esther Boyle, PhD Student, Sasha Pesic, PhD Student, Petar Jevtic, PhD, and Dragan Boscovic, PhD. 2021. "Peer-to-Peer Insurance: Blockchain Implications." Society of Actuaries 9.

Hoffmann, Jay. 2020. The History of the Web. July 29. Accessed April 16, 2023.

https://thehistoryoftheweb.com/postscript/pizzanet/.

Jaiman, Vikas, Leonard Pernice, and Visara Urovi. 2022. "User incentives for blockchain-based data sharing platforms." Plos One.

James, Margaret. 2022. Investopedia. October 23. Accessed April 16, 2023.

https://www.investopedia.com/web-20-web-30-5208698.

Lastovetska, Anastasiia. 2021. MLSDev. November 12. Accessed April 16, 2023.

https://mlsdev.com/blog/156-how-to-build-your-own-blockchain-architecture.

Lorenz, Johannes-Tobias, Björn Münstermann, Matt Higginson, Peter Braad Olesen, Nina Bohlken, and Valentino Ricciardi. 2016. "Blockchain in insurance- opportunity or threat?" McKinsey & Company 1-9.

Szakiel, Patrick. 2022. G2: How Smart Contracts Are Changing the Way We Do Business. January 6. Accessed April 17, 2023.

https://www.g2.com/articles/smart-contracts.